Earnings Before Interest And Taxes Earnings before taxes

Earnings Before Interest And Taxes Earnings before taxes - Search results - Wiki Earnings Before Interest And Taxes Earnings Before Taxes

The page "Earnings+Before+Interest+And+Taxes+Earnings+before+taxes" does not exist. You can create a draft and submit it for review or request that a redirect be created, but consider checking the search results below to see whether the topic is already covered.

A company's earnings before interest, taxes, depreciation, and amortization (commonly abbreviated EBITDA, pronounced /iːbɪtˈdɑː/, /əˈbɪtdɑː/, or /ˈɛbɪtdɑː/)...

A company's earnings before interest, taxes, depreciation, and amortization (commonly abbreviated EBITDA, pronounced /iːbɪtˈdɑː/, /əˈbɪtdɑː/, or /ˈɛbɪtdɑː/)... accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses (operating and non-operating)...

accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses (operating and non-operating)...- (earnings before interest and taxes) and EBITDA (earnings before interest, taxes, depreciation, and amortization). Many alternative terms for earnings...

- Gross income (redirect from Gross annual earnings)interest payments. This is different from operating profit (earnings before interest and taxes). Gross margin is often used interchangeably with gross profit...

- jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the...

all states impose interest charges on late payments of tax, and generally also on additional taxes due upon adjustment by the taxing authority.[citation...

all states impose interest charges on late payments of tax, and generally also on additional taxes due upon adjustment by the taxing authority.[citation... The price–earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company's share (stock) price to the company's earnings per share. The...

The price–earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company's share (stock) price to the company's earnings per share. The... Net income (redirect from Net earnings)amortization = Earnings before interest and taxes (EBIT) - Interest expense (cost of borrowing money) = Earnings before taxes (EBT) - Tax expense = Net income (EAT)...

Net income (redirect from Net earnings)amortization = Earnings before interest and taxes (EBIT) - Interest expense (cost of borrowing money) = Earnings before taxes (EBT) - Tax expense = Net income (EAT)... Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. It is a key measure of corporate profitability...

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. It is a key measure of corporate profitability...- modifications, and may be defined in great detail within each country's tax system. Such taxes may include income or other taxes. The tax systems of most...

- type of tax is applied to corporations and firms, it is called corporate income tax. Transfer taxes: the most frequent form of transfer taxes is the estate...

corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules...

corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules... earnings. NOPAT is precisely calculated as: NOPAT = (Net Income - after-tax Non-operating Gains + after-tax Non-operating Losses + after-tax Interest...

earnings. NOPAT is precisely calculated as: NOPAT = (Net Income - after-tax Non-operating Gains + after-tax Non-operating Losses + after-tax Interest...- different companies have different debt levels and tax rates. Earnings Yield = (Earnings Before Interest & Taxes + Depreciation – CapEx) / Enterprise Value...

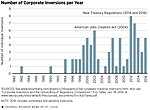

headquarters to another country with a territorial tax regime, the corporation typically pays taxes on its earnings in each of those countries at the specific...

headquarters to another country with a territorial tax regime, the corporation typically pays taxes on its earnings in each of those countries at the specific...- incentive stock options and held onto the shares, hoping to pay long-term capital gains taxes instead of short-term capital gains taxes. Many of these people...

- century: The first dividend taxes were imposed in the 17th century in the Netherlands and England. 19th century: Dividend taxes became more common in the...

- individuals, who owe greater than $3000 in net taxes in 2019 and one of the previous two years. Taxes must be paid in a series of quarterly installments...

together. A difference of earnings in even one category makes the Assessee liable to fill a separate and applicable Income Tax Returns Form. Any Individual...

together. A difference of earnings in even one category makes the Assessee liable to fill a separate and applicable Income Tax Returns Form. Any Individual...- U.S. firms with foreign affiliates in certain tax havens pay lower foreign taxes and higher U.S. taxes than do otherwise-similar large U.S. companies...

- of the taxes and interest due under the assessments under said Laws of 1883, including taxes on both territorial and interstate earnings, before they can

- savings tax-deductible and to let your savings and investments grow tax-free. For most people, there is no reason to pay any taxes on the earnings from the

- On Sample EBIT : Earnings Before Interests and Taxes; Shows the result of the company before Interest expenditures and Income Taxes. It differs from.