Tax Rates In Europe

This is a list of the maximum potential tax rates around Europe for certain income brackets.

This article needs additional citations for verification. (August 2014) |

It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

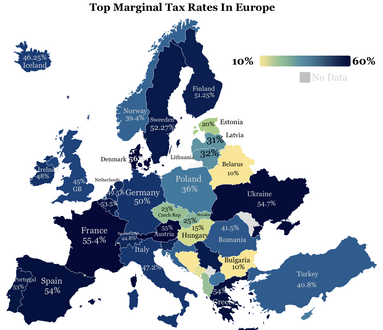

Graphs

- Top Marginal Tax Rates In Europe 2022

- Payroll and income tax by OECD Country (2021)

- Federal Sales Taxes

Summary list

The quoted income tax rate is, except where noted, the top rate of tax: most jurisdictions have lower rate of taxes for low levels of income. Some countries also have lower rates of corporation tax for smaller companies. In 1980, the top rates of most European countries were above 60%. Today most European countries have rates below 50%.

| Country | Corporate tax | Maximum income tax rate | Standard VAT rate |

|---|---|---|---|

| Albania | 15% | 23% | 20% |

| Andorra | 10% | 10% | 4.5% |

| Armenia | 18% | 22% | 20% |

| Austria | 25% | 55% | 20% (Reduced rates 10% + 13%) |

| Belarus | 18% | 15% | 20% |

| Belgium | 25% (For SME's 20% from 2018 on the first €100,000 profit) | 50% (excluding 13.07% social security paid by the employee and also excluding 32% social security paid by the employer) | 21% (Reduced rates of 6% and 12%) |

| Bosnia and Herzegovina | 10% | 10% | 17% |

| Bulgaria | 10% | 40.8% (10% income tax + additional 12.9% by the employee for social security contributions, i.e. health insurance, pension and unemployment fund); and additional 17.9% by the employer for various social security contributions) | 20% (Reduced rates 9%) |

| Croatia | 18% (Reduced rate 10% for small business) | 15% to 35,4% (depending on the income and municipality) | 25% (Reduced rates 13% + 5%)(Reduced rates 9%) |

| Cyprus | 12.5% | 35% | 19% (Reduced rates 5% + 9%)(Reduced rates 9%) |

| Czech Republic | 21% | 34% (15% or 23% tax, 4,5% health insurance, 6,5% social security) + additional payments by employer (11,5% healthcare, 24,8% social security) | 21% (reduced rate 12%) |

| Denmark | 22% | 56% (avg commune) (including 8% social security paid by the employee but excluding 0.42–1.48% church tax imposed on members of the national Church of Denmark) | 25% (reduced rate 0% on transportation of passengers and newspapers normally published at a rate of more than one issue per month) |

| Estonia | 0% on undistributed profits. 20% CIT on distributed profit. 14% on regular distribution. | 57.8% (20% income tax + 2.4% of unemployment insurance tax, 0.8% paid by employer, 1.6% paid by employee and 33% social security which is paid before gross wage by employer), around 57,8% in total | 20% (reduced rate 9%) |

| Finland | 20% | 67% to 25% depending on the net income and municipality, including 7.8% social insurance fees, employee unemployment payment and employer unemployment payment, which is on average 18% (2018). | 24% (reduced rate of 14% for groceries and restaurants, 10% for books, medicine, transport of passengers and some others) |

| France | 30% (including social contributions) after 2018 ('PFU'), before: 33.3% (36.6% above €3.5M, 15% below €38k) | 49% (45% +4% for annual incomes above €250,000 for single taxpayers or above €500,000 for married couples) + social security and social contribution taxes at various rates, for example 17,2 % for capital gains, interests and dividends. | 20% (reduced rate of 10%, 5.5%, 2.1% and 0% for specific cases like some food, transportation, cultural goods, etc.) |

| Germany | 22.825% (few small villages) to 32.925% (in Munich) depending on the municipality. This includes the 15% CIT, 5.5% solidarity surcharge plus the trade tax payable to the municipality. | 47.475% which includes 45% income tax and 5.5% solidarity surcharge based on the total tax bill for incomes above €256,304. The entry tax rate is 14% for incomes exceeding the basic annual threshold of €9,000. | 19% (reduced rate of 7% applies e.g. on sales of certain foods, books and magazines, flowers and transports) |

| Georgia | 15% | 18% | |

| Greece | 24% | 65.67% (45% for >€40,000+ 7.5% Solidarity Tax for >€40000)+(26.95% Social Security for employees or up to 47.95% for private professionals) | 24% (Reduced rates 13% and 5%) |

| Hungary | 9% | Total: 43.16% Employee: 33.5% of gross salary (Employee expenses altogether of gross salary without children: 15% Income Tax (flat), Social Security: 10% Pension, 3% in cash + 4% in kind healthcare, 1.5% Labor Market contributions) Employer: 17% in addition to gross salary (15.5% Social Tax, 1.5% Training Fund Contribution) | 27% (Reduced rates 18% and 5%) |

| Iceland | 20% | 36.94% from 0 - 834.707 and 46.24% over 834.707 kr (2017) | 24% (12% reduced rate) |

| Ireland | 12.5% for trading income 25% for non-trading income | 40% over €40,000 for single, €49,000 for married taxpayers.Plus USC(Universal Social Charge)4.5% on income up to €70,044 and 8% on balance. Social insurance 4% | 23% |

| Isle of Man | 0% | 20% plus national insurance of under 12.8% | Same as United Kingdom (see below) |

| Italy | 27.9% (24% plus 3.9% municipal) | 45.83% (43% income tax + 2.03% regional income tax + 0.8% municipal income tax) | 22% (Reduced rates 10%, 5%, 4%) |

| Latvia | 20% CIT on distributed profit. 0% on undistributed profits. 15% on small businesses | 20%(income tax)[1] 35.09%(social insurance) Total up to 55.09% | 21% (reduced rates 12% and 0%) |

| Liechtenstein | 12.5% | 28% (max. 8% national and 20% municipal income tax) plus 4% of the taxpayer's net worth is subject to the same rate as wealth tax. 0% on capital gains. | 8% / 2.5% (till 31.12.2017) 7.7% / 2.5% (from 01.01.2018) |

| Lithuania | 15% (5% for small businesses) | 44.27% (effective tax rates: 34.27% social insurance (nominally it is 1.77% payable by employer + 19.5% payable by employee + from 1.8% to 3% optional accumulation of pence), 20% income | 21% (Reduced rates 5%, 9%) |

| Luxembourg | 24.94% (commercial activity); 5.718% on intellectual property income, royalties. | 45.78% (42% income tax + 9% solidarity surcharge calculated on the income tax) | 17% (Reduced rates 3%, 8%, 14%) |

| Republic of North Macedonia | 10% | 37% (includes income tax 10%, mandatory state pension 18%, mandatory public health insurance 7.3%, mandatory unemployment insurance 1.2%, mandatory personal injury insurance 0.5%) | 18% |

| Malta | 35% (6/7 or 5/7 tax refunds gives an effective rate of 5% or 10% for most companies) | 35% (additional 10% by the employee for social security contributions, i.e. health insurance, pension and education); and additional 10% by the employer for various social security contributions) | 18% (Reduced rates 5%, 7% and 0% for life necessities – groceries, water, prescription medications, medical equipment and supplies, public transport, children's education fees) |

| Monaco | 0% (>75% revenue within Monaco) or 33.33% | ||

| Moldova | 12% or 7% for IT businesses | ||

| Montenegro | 9% | 12.65% (11% income tax + 15% of the income tax bill to the municipality) | 21% |

| Netherlands | 19% for the first €200.000 of profit, 25,8% for the rest. | 49.5% (excluding income dependent bracket discount for incomes up to €98.604) | 21% (reduced rate of 9% and 0% for some goods and services) |

| Norway | 22% | 46.4% (53.0% including 14.1% social security contribution by employer. All taxes include 8.2% pension fund payments). | 25% (reduced rate of 15% for groceries, and 10% for transport and culture.) |

| Poland | 19% (Reduced rate 9% for small business since 01.01.2019) | 17% up to 120 000 zł (from 1.01.2022) 32% above 120 000 zł (~25 000 euro) | 23% (reduced rates of 5% and 8%) |

| Portugal | 21% + 3 to 9% depending on profit | 48% + 5% solidarity surcharge + 11% social security (paid by the employee) + 23,75% (social security paid by the company) | 23% (reduced rates 13% and 6%) |

| Romania | Revenue <€1m & at least one employee: 1% of all sales + 8% on dividends Revenue >€1m or no employee: 16% on profit + 8% on dividends | Employee: 41.5% [10% income tax (out of gross minus pension & health deductions), 25% pension contribution (out of gross), 10% health contribution (out of gross)] - Gross incomes below RON 3,600 benefit from personal deductions of up to RON 1,310 from taxable income. Employer: 2.25% (compulsory work insurance) | 19% (reduced rates of 9% and 5%) |

| Russia | 20% | 43% (13.0% income tax, 22.0% mandatory pension fund contribution, 2.9% unemployment insurance, 5.1% mandatory universal health insurance) | 20% |

| Serbia | 15% | 52% (capital gains tax 15%, standard income tax rate 10%, additional contributions by employee: 13% state pension fund, 6.5% state health fund, 0.5% unemployment fund; additional contributions by employer: 11% state pension fund, 6.5% state health fund, 0.5% unemployment; maximum contributions capped (amount changing monthly); additional tax for higher salaries (after 3 times average salary additional 10%, after 6 times average salary additional 15%)), | 20% (10% reduced rate) |

| Slovakia | 21% | 50% (income tax 19% + 25% for the part of annual income greater than €35,022.31; additional contributions at 4% mandatory health insurance by employee and 10% by employer, 9.4% Social Security by employee and 25.2% by employer) | 20% (10% reduced rate) |

| Slovenia | 19% | 50% | 22% (reduced rate 9.5%) – from 1 July 2013 |

| Spain | 25% 4% in the Canary Islands | 45% maximum Income tax rate. Not including employee contribution of 6.35% Social Security tax, 4.7% pension contribution tax, 1.55% unemployment tax, 0.1% worker training tax. Not including employer contribution of 23.6% Social security tax, 5.5% unemployment tax, 3.5% (or more) workers comp tax, worker training tax .06%, 0.2% FOGASA tax (employment tax in case of company bankruptcy). | 21% (reduced rates 10% and 4%) |

| Sweden | 22% (21.4% 2019, 20.6% 2021) | 55.5% (Not including payroll taxes of 31.42%) | 25% (reduced rates 12% and 6%) |

| Switzerland | 16.55% | 22.5% (Kanton Zug, Gemeinde Walchwil) to 46% (Kanton Geneve), average rate 34%. These taxes do not include social security that is private and not income based (e. ) | 8% / 2.5% (till 31.12.2017) 7.7% / 2.5% (from 01.01.2018 until 31.12.2023) |

| Ukraine | 18% | 41.5% (Income tax 18%, military tax 1.5%, social contribution tax 22%[2]) | 20% |

| United Kingdom | 19% | 47% (45% income tax + 2% National Insurance). Not including Employer's National Insurance payroll tax of 13.8%. In Scotland, the top marginal rate is 49% (47% income tax + 2% NI). For earnings between £100,000 - £125,140 employees pay the 40% higher rate income tax + removal of tax-free personal allowance + 2% NI (effectively a 67% marginal rate). The top tax rate on dividend income is 39.35%. Capital gains top tax rates are 20% for securities and 28% on property gains. National Insurance is not charged on property income so it is only liable to Income Tax at 45% above £125,140. | 20% (reduced rate of 5% for home energy and renovations, 0% for life necessities – groceries, water, prescription medications, medical equipment and supplies, public transport, children's clothing, books and periodicals) |

Per country information: income tax bands

Austria

Austrian income taxation is determined by §33 of Austrian Income Tax Code (Einkommensteuergesetz - EStG)

| Annual Income [€] | Taxation Rate [%] |

|---|---|

| 0 - 12,816 | 0 |

| 12,816 - 20,818 | 20 |

| 20,818 - 34,513 | 30 |

| 34,513 - 66,612 | 41 |

| 66,612 - 99,266 | 48 |

| 99,266 - 1,000,000 | 50 |

| >1,000,000 | 55 |

Until the end of the year 2024 an additional tax (55%) will affect income of over 1 million €.Source

Belgium

| Annual Income [€] | Taxation Rate [%] |

|---|---|

| 0 – 9050 | 0 |

| 9050 – 22590 | 25 |

| 22590 – 32950 | 40 |

| 32950 – 50410 | 45 |

| >50410 | 50 |

Croatia

| Annual income [€] | Tax Rate |

|---|---|

| Less than 47,780.21 | 20 |

| More than 47,780.21 | 30 |

Denmark

Finland

The total Finnish income tax includes the income tax dependable on the net salary, employee unemployment payment, and employer unemployment payment. The tax rate increases very progressively rapidly at 13 ke/year (from 25% to 48%) and at 29 ke/year to 55% and eventually reaches 67% at 83 ke/year, while little decreases at 127 ke/year to 65%. The middle-income person will get 44 euros from every 100 euros the employer puts on the work. The GP will then again get from every extra 100 euros that the employer puts on the work only 33 euros. Some sources do not include the employer unemployment payment, for instance Veronmaksajat -organisation.

| Annual income at | Tax rate (including employer unemployment payment) |

|---|---|

| €13,000 | 25% |

| €33,000 | 57% |

| €47,000 | 60% |

| €83,000 | 67% |

| €94,000 | 66% |

| €127,000 | 65% |

France

Income tax in France depends on the number of people in the household. The taxable income is divided by the number of persons belonging to the household. Each adult counts as one person while the first two children count as half each. From the third child onwards each child counts as one person. Therefore, a household comprising 2 adults and 3 children is considered to be a household of 4 persons for tax purposes.

The rates below do not include the 17% social security contributions.

| Annual income above | Annual income below | Tax rate |

|---|---|---|

| €0 | €5,963 | 0% |

| €5,963 | €11,896 | 5.5% |

| €11,896 | €26,420 | 14% |

| €26,420 | €70,830 | 30% |

| €70,830 | - | 41% |

Germany

German income tax comprises 5 income tax bands, with the first two being based on a totally Progressive tax rate and the rest being flat rate. Taxable income is derived after subtracting personal and child allowances from earned income. In addition a number of other deductions may be claimed by German taxpayers.

- Personal allowance: €9,000 per adult

- Child allowance: €7,428 per child

| Annual income above | Annual income below | Marginal tax rate 2018 |

|---|---|---|

| €0 | €9,000 | 0% |

| €9,000 | €13,996 | 14% − 23.97% |

| €13,996 | €54,949 | 23.97% − 42% |

| €54,949 | €260,532 | 42% |

| €260,532 | - | 45% |

In Germany, married couples are taxed jointly. This means that the tax liability for the couple is twice the amount resulting from the tariff when inserting the average income of both spouses. Due to the progressive tariff, filing jointly uniformly reduces the total tax burden if spouses' incomes differ.

Italy

- Personal Allowance: €800 per adult[citation needed]

- Allowance per child: €1,120

| Annual income Above | Annual income below | Tax rate |

|---|---|---|

| €0 | €15,000 | 23% |

| €15,000 | €28,000 | 27% |

| €28,000 | €55,000 | 38% |

| €55,000 | €75,000 | 41% |

| €75,000 | - | 43% |

Netherlands

Income tax in the Netherlands (Inkomstenbelasting, Box 1) and social security contributions are combined in one payroll tax. There are no personal tax-free allowances; however, there are personal and labor tax credits that reduce the amount of income tax paid.

Prior to 2020, the income tax was assessed within four brackets, which have been simplified to just three (effectively two) as of 2020. As of 2023, the income tax rates are:

| Annual income above | Annual income below | Tax rate (including employee social security) |

|---|---|---|

| €0 | €73,031 | 36.93% |

| €73,031 | - | 49.50%* |

- Income-dependent deductions and tax credits apply to incomes up to €98,604.

Portugal

Income tax in Portugal depends on a number of factors, including regional (different tax rates depending if you live in the mainland, the Azores or Madeira regions, marital status and number of dependents.

For simplification purposes, the following is a summary of the major tax brackets.

| Taxable Income | Tax Rate (Mainland) | Tax Rate (Madeira) | Tax Rate (Azores) |

|---|---|---|---|

| Up to €7,091 | 14.5% | 11.6% | 10.15% |

| €7,091 and €10,700 | 23% | 20.7% | 17.25% |

| €10,700 and €20,261 | 28.5% | 26.5% | 21.38% |

| €20,261 and €25,000 | 35% | 33.75% | 28% |

| €25,000 and €36,856 | 37% | 35.87% | 29.6% |

| €36,856 and €80,640 | 45% | 44.95% | 36% |

| Above €80,640 | 48% | 48% | 38.4% |

A solidarity additional tax of 2.5% is applied on income between €80,640 and €250,000. All income above €250,000 is taxed a further 5%.

Spain

Spanish income tax includes a personal tax free allowance and an allowance per child. In 2012 a special temporary surcharge was introduced as part of austerity measures to balance the budget. The personal allowance currently stands at €5,151.

- 1st child €1,836

- 2nd child €2,040

- 3rd child €3,672

- 4th & subs €4,182

| Annual income above | Annual income below | Tax rate (excluding temporary surcharge) | Tax rate (including temporary surcharge) |

|---|---|---|---|

| €0 | €5,150 | 0% | 0% |

| €5,150 | €17,707.20 | 24% | 24.75% |

| €17,707.20 | €33,007.20 | 28% | 30% |

| €33,007.20 | €53,407.20 | 37% | 40% |

| €53,407.20 | €120,000.20 | 43% | 47% |

| €120,000.20 | €175,000.20 | 44% | 49% |

| €175,000.20 | €300,000.20 | 45% | 51% |

| €300,000.20 | - | 45% | 52% |

United Kingdom

Income tax for the United Kingdom is based on 2023/24 tax bands. The current tax free threshold on earnings is £12,570. The relief is tapered by £1 for every £2 earned over £100,000, resulting in an effective 60% tax rate for incomes between £100,000 and £125,140.

| Annual income | Tax rate | |

|---|---|---|

| Above | Up to | |

| £0 | £12,570 | 0% |

| £12,570 | £50,270 | 20% |

| £50,270 | £125,140 | 40% |

| £125,140 | — | 45% |

See also

References

External links

- The Tax Foundation

- VAT Rates Applied in the Member States of the European Union, 1 July 2013, European Commission

- Excise duties on alcohol, tobacco and energy, 1 July 2013, European Commission

- HM Revenue & Customs: Corporation Tax rates

- European VAT Rates

This article uses material from the Wikipedia English article Tax rates in Europe, which is released under the Creative Commons Attribution-ShareAlike 3.0 license ("CC BY-SA 3.0"); additional terms may apply (view authors). Content is available under CC BY-SA 4.0 unless otherwise noted. Images, videos and audio are available under their respective licenses.

®Wikipedia is a registered trademark of the Wiki Foundation, Inc. Wiki English (DUHOCTRUNGQUOC.VN) is an independent company and has no affiliation with Wiki Foundation.